Navigating the financial aid application process can be overwhelming, leaving you wondering how to secure the funds you need to pursue higher education. The types of financial aid available, eligibility criteria, and application procedures can be complex and confusing. But fear not! This comprehensive guide will demystify the process, providing a step-by-step roadmap to help you maximize your financial aid award and unlock your educational aspirations.

Types of Financial Aid Available

When it comes to paying for college, there are a variety of financial aid options available to help students cover the costs. These options can include grants, scholarships, loans, and work-study programs. Grants and scholarships are free money that does not need to be repaid, while loans must be repaid with interest. Work-study programs allow students to earn money to help pay for college expenses.

There are a variety of different types of grants and scholarships available, each with its own eligibility criteria. Some grants and scholarships are based on financial need, while others are based on academic merit or other factors. Some grants and scholarships are also available to students from specific backgrounds or who are pursuing specific fields of study.

Loans are another common type of financial aid. Loans must be repaid with interest, but they can be a good option for students who need to borrow money to cover the costs of college. There are a variety of different types of loans available, each with its own interest rates and repayment terms. Some loans are federal loans, while others are private loans.

Work-study programs allow students to earn money to help pay for college expenses. Students who participate in work-study programs work part-time jobs on campus or in the community. The money they earn can be used to help pay for tuition, fees, books, and other expenses.

Government Grants

The federal government offers a variety of grants to help students pay for college. These grants are based on financial need, and they do not need to be repaid. Some of the most common federal grants include the Pell Grant, the Supplemental Educational Opportunity Grant (SEOG), and the Teacher Education Assistance for College and Higher Education (TEACH) Grant.

To be eligible for a federal grant, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is a form that collects information about the student’s family income and assets. The FAFSA is used to determine the student’s expected family contribution (EFC). The EFC is the amount of money that the student’s family is expected to contribute to the student’s education.

The amount of the grant that a student receives is based on the student’s EFC and the cost of attendance at the school that the student is attending. The cost of attendance includes tuition, fees, room and board, and other expenses.

Scholarships

Scholarships are another source of free money that can help students pay for college. Scholarships are awarded based on a variety of criteria, such as academic merit, financial need, or other factors. Some scholarships are offered by colleges and universities, while others are offered by private organizations.

To find scholarships, students can search online databases or contact the financial aid office at the school that they are attending. Students can also apply for scholarships through the FAFSA.

The amount of the scholarship that a student receives is based on the criteria that the scholarship is based on. Some scholarships are full scholarships, while others are partial scholarships. Full scholarships cover the full cost of attendance, while partial scholarships cover only a portion of the cost of attendance.

Eligibility Criteria for Financial Aid

To be eligible for financial aid, students must meet certain eligibility criteria. These criteria include being a U.S. citizen or eligible non-citizen, being enrolled in an eligible program of study, and making satisfactory academic progress.

U.S. Citizenship or Eligible Non-Citizen Status

To be eligible for federal financial aid, students must be U.S. citizens or eligible non-citizens. Eligible non-citizens include permanent residents, refugees, and asylees.

Students who are not U.S. citizens or eligible non-citizens may be able to receive financial aid from state or private sources. However, the eligibility criteria for these programs may vary.

Enrollment in an Eligible Program of Study

To be eligible for financial aid, students must be enrolled in an eligible program of study. Eligible programs of study include undergraduate and graduate programs at accredited colleges and universities.

Students who are not enrolled in an eligible program of study may not be eligible for financial aid. However, some students may be eligible for financial aid if they are enrolled in a vocational or technical program.

Satisfactory Academic Progress

To be eligible for financial aid, students must make satisfactory academic progress. Satisfactory academic progress is defined by the school that the student is attending. Generally, students must maintain a certain grade point average and complete a certain number of credits each semester.

Students who do not make satisfactory academic progress may lose their financial aid eligibility. However, students may be able to regain their eligibility if they improve their academic performance.

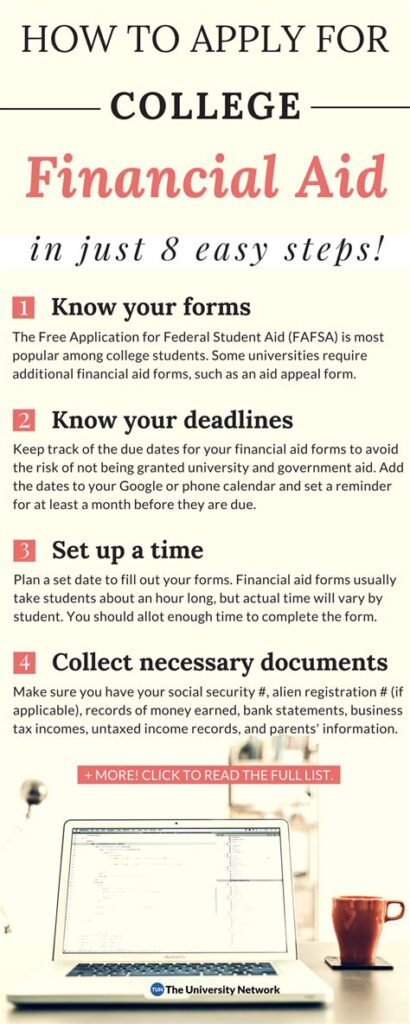

Step-by-Step Guide to Applying for Financial Aid

Applying for financial aid can be a complex process, but it is important to complete the process carefully and accurately. The following is a step-by-step guide to applying for financial aid:

1. Gather Your Information

Before you apply for financial aid, you will need to gather some information. This information includes your Social Security number, your parents’ Social Security numbers (if you are a dependent student), and your financial information. You can find your Social Security number on your Social Security card.

You can also use the IRS Data Retrieval Tool to transfer your tax information directly into your FAFSA. The IRS Data Retrieval Tool is available on the FAFSA website.

2. Create an FSA ID

You will need to create an FSA ID to sign your FAFSA. Your FSA ID is a username and password that you will use to access your FAFSA and other federal student aid accounts.

You can create an FSA ID on the Federal Student Aid website.

3. Complete the FAFSA

The FAFSA is the Free Application for Federal Student Aid. The FAFSA is used to determine your eligibility for federal financial aid. You can complete the FAFSA online or by mail.

The FAFSA is available on the Federal Student Aid website.

4. Submit the FAFSA

Once you have completed the FAFSA, you will need to submit it. You can submit the FAFSA online or by mail. If you submit the FAFSA online, you will receive an email confirmation.

If you submit the FAFSA by mail, you will receive a paper confirmation.

5. Wait for Your Award Letter

Once you have submitted your FAFSA, you will need to wait for your award letter. Your award letter will list the types and amounts of financial aid that you have been awarded.

You can view your award letter online or by mail.

6. Accept Your Financial Aid

Once you have received your award letter, you will need to accept your financial aid. You can accept your financial aid online or by mail. If you accept your financial aid online, you will receive an email confirmation.

If you accept your financial aid by mail, you will receive a paper confirmation.

Common Mistakes to Avoid When Applying for Financial Aid

There are a number of common mistakes that students make when applying for financial aid. These mistakes can delay the processing of your FAFSA or result in you receiving less financial aid than you are eligible for.

Here are some common mistakes to avoid when applying for financial aid:

1. Not Completing the FAFSA

The FAFSA is the key to getting financial aid. If you do not complete the FAFSA, you will not be eligible for federal financial aid.

Even if you think you will not qualify for financial aid, it is still important to complete the FAFSA. The FAFSA is used to determine your eligibility for all types of financial aid, including grants, scholarships, and loans.

2. Submitting an Incomplete FAFSA

It is important to make sure that you complete the FAFSA carefully and accurately. If you submit an incomplete FAFSA, it will be delayed or rejected.

Make sure that you answer all of the questions on the FAFSA and that you provide all of the required information.

3. Using Estimated Information

It is important to use accurate information when completing the FAFSA. If you use estimated information, your FAFSA may be delayed or rejected.

If you are not sure about an answer to a question on the FAFSA, leave it blank. You can contact the financial aid office at your school for help.

4. Missing Deadlines

It is important to meet all of the deadlines for applying for financial aid. If you miss a deadline, you may lose out on financial aid.

The FAFSA deadline is June 30th for the following school year. However, some states have earlier deadlines. Check with the financial aid office at your school for the deadline in your state.